Tokenization of assets has emerged as a pivotal innovation, offering the potential to revolutionize asset management and investment strategies for enterprises.

Amid this transformation, the Ethereum blockchain has introduced various standards to facilitate the development and management of digital assets.

One such standard is ERC-3643, designed specifically for creating tokenized assets with an emphasis on compliance, flexibility, and efficiency.

It’s important to note that ERC-3643, also known as Token for Regulated EXchanges (T-REX), is intricately linked to Tokeny and bears a complex structure that might be challenging for broad adoption. But it has some interesting characteristics that make it valuable to enterprise use cases.

This post will explore the benefits, functionalities, and practical applications of ERC-3643, guiding enterprises in leveraging this standard for tokenizing assets.

The proliferation of digital assets and tokens on blockchain platforms has necessitated the creation of standards that ensure security, interoperability, and regulatory compliance.

For enterprises, the ability to tokenize assets—ranging from real estate and commodities to intellectual property and financial instruments—requires a robust framework that can accommodate the complexities of legal and market conditions.

ERC-3643 emerges as a solution, offering a structured approach to asset tokenization that aligns with enterprise needs for security, compliance, and efficiency.

As of December 15, 2023, ERC-3643 has achieved 'Final' status as an Ethereum Improvement Proposal (EIP), marking it as the first-ever standard tailored for compliant tokenization to earn this approval from the Ethereum community. This milestone highlights its significance and broad support within the Ethereum ecosystem. Tokeny continues to actively develop and update its implementation, underscoring its ongoing relevance and adaptation to market needs.

ERC-3643 is built with the goal of providing a comprehensive framework for tokenized assets, focusing on the following aspects:

ERC-3643's versatile framework makes it suitable for a wide range of applications within the enterprise sector:

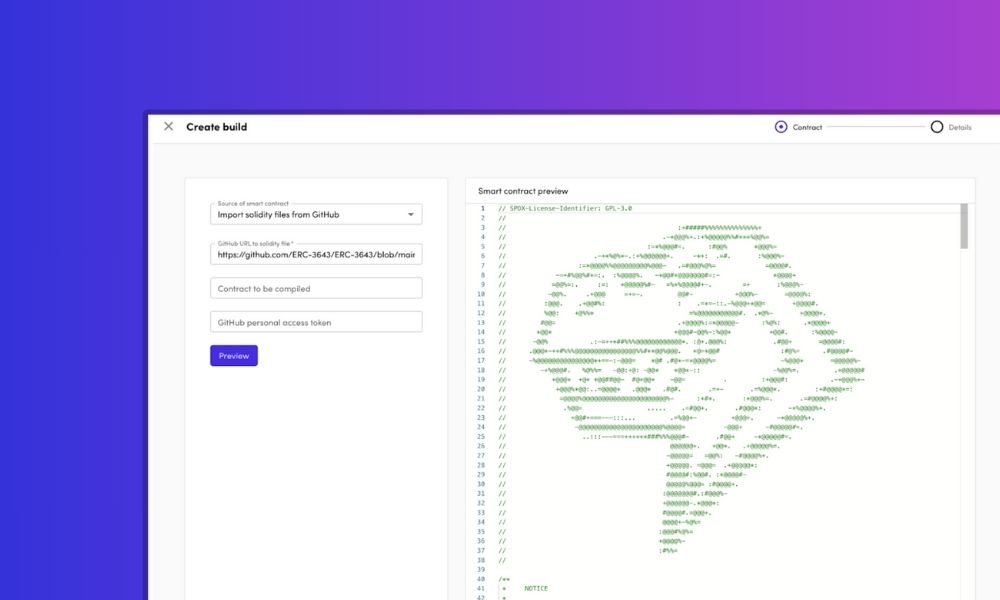

ERC-3643 contracts are available on various online repositories or marketplaces specializing in blockchain-based assets and contracts.

Given the technical specificity and identity management intricacies involved, incorporating ERC-3643 can be challenging.

It mandates identity management via ONCHAINID, with a main token contract that is dependent on several 'child' contracts for compliance and identity verification, which could complicate integration.

For enterprises looking to navigate the complexities of digital asset management and tokenization, ERC-3643 offers a robust, compliant, and efficient standard. By embracing this standard, organizations can unlock new opportunities for asset management, investment, and innovation, setting the stage for a new era in digital asset utilization.

At Kaleido, we’re focused on building a tokenization platform that makes digital asset management much simpler for the enterprise.

We’ve also introduced a revolutionary new engine for enterprise real-world assets. Our Asset Manager provides a groundbreaking open source policy engine, a new paradigm for scaling asset and data models to real-world demands, and more.

To learn more about standards like ERC-3643 and how they will play a role in bridging the gap between traditional asset management practices and the demands of the digital economy, schedule a talk with one of our solutions architects.

The Kaleido Asset Platform can radically accelerate your digital asset strategy.

Request a DemoThe Kaleido Asset Platform can radically accelerate your digital asset strategy.

Request a Demo

The Kaleido Asset Platform can radically accelerate your digital asset strategy.

Request a DemoThe Kaleido Asset Platform can radically accelerate your digital asset strategy.

Request a Demo

Your guide to everything from asset tokenization to zero knowledge proofs

Download Now

Learn how Swift, the world’s leading provider of secure financial messaging services, utilizes Kaleido in its CBDC Sandbox project.

Download Now